“When talking about prime locations, the availability of restaurants is diminishing as the country continues to open up. Many excellent opportunities have been acquired,” said Alan W. Howard of Kerdyk Real Estate in Florida, while adding “Full-service restaurant opportunities will continue to be significant, especially in prime markets.”

Labor Shortages Force Businesses to Make Tough Choices

As Main Street opens back up, many small businesses are struggling to rebuild pre-pandemic operations. Nearly half (47%) of business owners surveyed that depend on labor say they are having difficulty hiring or retaining employees. This is presenting a major challenge to small business as owners are forced to choose between raising wages or cutting business hours in attempt to keep pace with customer demand.

“We are running at 75% of previous staffing levels, yet, could have doubled in size if we’d had more people. Gave raises to all current employees at beginning of year whether deserved or not because of how much we had to advertise pay rates to attract workers, so now we just have increased payroll and decreased productivity. 2021 has been a disaster,” said Kevin Spicher of Spicher Services in Michigan.

Spicher adds, “Ours is a younger labor force, right in the wheelhouse of the stimulus money, whereby they can make more by working, but it’s hard work, so they choose to stay home and not work for enough money to get by.”

Over half (59%) of surveyed owners agree with Spicher’s sentiment, attributing the labor shortage to stimulus money deterring people from returning to work. An additional seventeen percent believe it is due to their inability to compete with higher wages. Significantly, 81% of these owners have increased wages to attract or retain employees, while 17% have reduced operating hours due to being short-staffed.

Supply Shortages Impact Financial Performance, 61% of Owners Say They’ve Increased Prices

Further complicating operations, nearly half of owners (48%) have experienced a shortage of goods and supplies. An even higher 76% of owners are seeing rising costs. These issues began in 2019 due to U.S.-China trade tariffs and have only worsened during the pandemic.

“93% of all bicycles and bike components are made in China and Taiwan. Among all the changes and challenges of this time, we’ve seen our costs increase dramatically. Inbound freight and ocean freight costs have more than tripled – what used to be $2,500 for a container is now $15,000,” said David Toma of Phantom Bikes, Inc. in California. Toma also notes a 50% increase in outbound freight costs, 25% tariffs and 20%-30% increase in production raw material and manufacturing.

“Containers are in short supply, goods in transport are delayed by up to 6 months, supply chain is disrupted, and cost of goods go up,” says Toma who has tried to absorb costs.

However, as his suppliers continue to increase prices, Toma is now unable to afford to offer low pre-pandemic prices. In fact, 61% of surveyed owners facing supply challenges are passing rising costs to customers.

Other items of note where owners are seeing dramatic costs increases include auto parts, cleaning supplies, copper and other metals, milk, butter, eggs, poultry, lumber, and finishing materials. This in conjunction with shipping delays generally lasting multiple weeks to months.

Rising supply chain costs appear to be taking the biggest toll on the manufacturing sector, where median cash flow of sold businesses is down 16% compared to Q1 and 15% versus Q2 a year ago. The median revenue drop is even more substantial, down 18% and 31% respectively. For context, the next largest drop in revenue occurs in the service sector with an 8% decline compared to Q1 and 6% down versus last year. This likely contributes to manufacturing transactions dropping 9% versus last quarter as companies focus on steadying operations.

“We’ve seen a noticeable drop off in 2021 of manufacturing owners listing for sale,” said Max Friar of Calder Capital, LLC.“I believe this is for a number of reasons. Many were negatively impacted by COVID and do not want to sell for a perceived discount; many continue to face significant challenges with hiring; supply chain awkwardness and stiff raw material price increases are causing delays and headaches. The combination of these factors, in my opinion, have caused many would-be sellers to hold off.”

The Rise of Retail – Restaurant Sale Prices Jump 34% as Transactions Return

The second quarter saw dramatic upticks in retail and restaurant acquisitions, as buyers look ahead to a comeback in growth opportunities. The number of restaurants changing hands increased 17% compared to last quarter, with median sale prices jumping 34% to $200,000, and average revenue multiples up 23%. While quick serve restaurants such as pizzerias and those catering to mobile orders have done well during the pandemic, these large spikes hint toward the return of traditional dine-in restaurants to the market.

According to brokers, owners of operating pandemic-impacted restaurants have fought off low-ball offers while battling to stay open, but are now becoming more in demand, particularly those with a great location or long-term lease. This will only increase as more of these ‘survivors’ turn to profit.

“2021 restaurant performance has definitely improved over 2020 but are probably on an annualized basis running at approximately 80% of 2019 sales and SDE (seller’s discretionary earnings) if the restaurant is profitable,” said Steve Zimmerman of President, CEO, Principal Broker & Founder of Restaurant Realty Company in California.

Retail acquisitions also saw a nice bump of 14% over the prior quarter, however, the median sales price dropped 11% to $262,000 as median cash flow and revenue decline 5% and 9% respectively. While rising costs may be to blame for lower financials, much opportunity still lies in this sector.

“Liquor stores have proven to be sustainable regardless of the situation in the world. Any business owner who lost their business during the pandemic should consider acquiring a liquor store,” said Chiharu Millhouse of Wine Wise Greenwich in Connecticut, who has seen costs increase due to tariffs and labor shortages but has been able to pass them along.

Owners See Workers Returning as Key to Recovery, Workers Seek Entrepreneurship

As we continue striving for a return of normalcy, the delays in returning to the workforce is having a major influence on businesses of all sizes – and for some it’s as much a challenge as COVID-19 restrictions. It may be the most important aspect of a recovery, according to Emmet Apolinario of Sunbelt Business Advisors in Columbus, Ohio.

“I believe the trend with the country’s re-opening is that we will be back to normal levels soon as everyone goes back to work. The employment and labor shortage has an impact to getting back to normal,” said Apolinario.

“The employment shift has had an impact on buyers (as a part of the ‘Great Quit of 2021’) and many are choosing to leave Corporate life. As a former corporate refugee myself, I totally understand this mindset,” said Diane Hartz Warsoff, CBI of Transworld Business Advisors of Utah County. Elizabeth Bellit of Upland Business Advisors, adds “Younger buyers are wanting control over their careers by owning their own business, where they are not subject to an employer’s success or failure.”

In addition, the flexibility or work-from-home environment many have endured for more than a year has expanded how far some are willing to go to find an ideal environment. When it comes to location, most buyers (46%) prefer to stay in their own city or county, 32% are looking throughout their state, while 22% are searching out of state.

Penny Patrizi, M&A Advisor of Capstone Business Broker LLC in Tampa Bay describes experiencing more out-of-state buyers as contributing to her listing engagements returning to pre-pandemic levels.

2021 Small Business Market Outlook

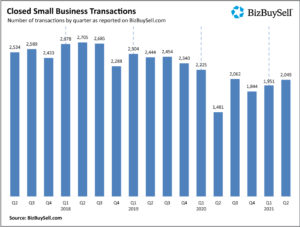

After 2020’s unexpected turn of events, and the now lingering uncertainty of COVID variants as a potential change to trajectory, anything is possible. However, all signs point to the business-for-sale market headed toward recovery. There has been no shortage of buyers in the market even as the pandemic disrupted nearly every aspect of the economy. While listing supply has been limited and slow to follow, this has presented a tremendous opportunity for some owners to get out on top.

However, as the market shifts toward recovery, the opportunity for COVID boosted businesses to sell high may be running out. According to surveyed buyers, 58% desire a business that is sustaining pre-pandemic values. Forty-six percent are considering one that has excelled. According to Friar, this comes down to suspicion of continuity of boosted performance in a post-pandemic world, a sentiment that is shared by lenders.

“Businesses that have excelled during the pandemic are, of course, quite popular, however, there seems to be buyer and lender skepticism regarding outsized pandemic performance. I feel that the top performers may need to show a strong 2021 to ‘legitimize’ their strong 2020. Buyers and lenders of Main Street and Lower Middle Market businesses seem to consistently prefer steady performers, even versus stellar growth,” said Friar.

Still, the primary reason the market has yet to fully recover is far too many owners find themselves in a less desirable position. According to brokers, the number one element needed to propel the market is revenue. Owners impacted by the pandemic still need to recover their losses.

As a great sign of progress toward recovery, 75% of surveyed owners describe their business as fully operating, with 36% indicating higher sales volume than before the pandemic and 28% indicating similar sales volume. This compared to 3 months ago, when 64% of owners indicated having an operating business, 29% saw higher sales volume, and 24% the same levels. In addition, most owners are feeling optimistic about the market, with 42% saying now is a good time to sell versus 25% who do not and 34% still unsure.

Furthermore, most (58%) business brokers expect more owners to sell in the second half of the year, with another 21% expecting significantly more. This sentiment primarily revolves around the country re-opening as indicated by 38% of business brokers. However, re-opening is simply the spark to reignite a major pre-pandemic catalyst.

“The overarching tailwind is the number of Baby Boomers who still own businesses. These Boomers will need to sell over the next few years. Most owners wanted to navigate the pandemic but now face a time where labor shortages are stifling further business growth and some of the fun of business ownership. For that and other reasons, older business owners will decide it’s time to move on,” said Matt Baas of Small Business Deal Advisors in Michigan.

In terms of timeframe to fully recover, most (22%) brokers and owners still expect a 10–12-month period. While today’s trajectory is on course, economic volatility remains high. Beyond COVID, tax reform and new government policies loom which could cause further complications or alternatively stimulate activity. When asked his expectations, Friar had the following to offer.

“This is difficult to predict. If one looks back at the Great Recession, it took a full 3-4 years for sale levels to recover. A few things exist now that didn’t then that should accelerate the recovery: The government’s response to COVID with PPP, EIDL, SBA 7a, etc. was more appropriate than its stumbling through 2009; Baby Boomers are older; Feelings of returning to normal, a nice summer, restaurants and travel re-opening are causing many owners to think ‘what am I doing? I need to move on.’”

Still certainties exist. If you are a business owner and do not have an exit plan, reach out to a local business broker, and begin developing one now. If you are a buyer, this may be the last call to acquire a business at a good price during the beginning of an economic upswing. And for everyone else, head down to Main Street and support your local small business owners.

Q2 2021 Small Business Values

On the surface, the median sale price of businesses sold in Q2 rose an impressive 12% versus a year ago, with the median asking price up 16%. However, this compares an opening economy versus the height of the pandemic shutdown. Comparing to Q1 shows a more complex dynamic.

While median sale and asking prices remain at Q1 levels, this is primarily driven by 34% and 29% spikes in respective restaurant prices. In fact, the median sale price declined for each manufacturing businesses (down 14%), retail (down 11%), and service (down 7%). For the bulk of the pandemic, high value restaurants have been mostly sidelined or forced to shut down as they generally rely on dine-in experiences. The large swing in asking and sale price indicates these larger sized restaurants have now recovered enough to begin entering the market.

“A vast majority of full-service restaurants in all major markets have been brutalized by the Pandemic. The good news is that segment of the Industry is making a strong comeback in 2021,” said Alan W. Howard of Kerdyk Real Estate in Florida.

Q2 2021 Small Business Financial Health

Labor and supply shortages have taken a toll on small business financials, presenting difficulty operating at full capacity. Supply challenges were first introduced in 2019 because of the US-China trade war and have only accelerated during the pandemic as shipping delays compound rising prices. In addition, COVID related economic fallout has added pressure on owners to aggressively increase pay or reduce hours to employ a full staff. As a result, small business financials have taken a hit, with Q2 median cash flow down 5% compared to Q1 and revenue down 13%.

Manufacturing companies account for the bulk of the decrease with a 16% median cash flow drop versus Q1. These businesses require specialized employees and rely most on larger scale oversees shipping. Conversely, restaurants saw cash flow rise 20%, however this has more to do with larger, dine-in restaurants entering the market through the window of an opening economy, inflating values.

Service businesses continue to show their resiliency to weather any storm with flat quarter over quarter transactions and acquisition financials. According to surveyed buyers, service businesses are the most sought-after acquisition in today’s market after at 38%, followed by restaurants at 31%, retail at 30%, and manufacturing at 22%. It’s important to note that manufacturing companies generally require a higher degree of specializations and capital, which also factors in the lower percentage.

“Based on our lead flow in June 2021, manufacturing is coming back and we expect to see quite a few more opportunities. Construction remains strong and we are seeing more leads and clients in that industry than in past years,” said Max Friar of Calder Capital, LLC.

Q2 2021 by Deal Size

Nineteen percent of transactions sold for a price of $1 million or higher during the Q2 2021 which mirrors the amount sold the prior quarter. These larger businesses contained a median cash flow of $538,727 and were on the market for 168 days, compared to $140,905 and 185 days nationally for all businesses. The 168-day time frame saw a steep decline from 197 days in Q1 and represents the 3rd consecutive quarter of faster sales since the high of 216 days seen in the 3rd quarter of 2020.

In addition, businesses selling for $1 million or higher averaged a .93 revenue multiple and 3.66 cash flow multiple, significantly higher than the .67 and 2.54 multiples, respectively, for all businesses. Lastly, most of these larger acquisitions occurred in the service industry (40%), followed by retail (25%), manufacturing (9%) and restaurant (3%) sectors. The sector breakdown follows the same trend seen last quarter.

“We listed an IT consulting firm and within 2 weeks had over 130 inquiries and 2 LOIs. Another one listed and within 3 weeks had 3 LOIs. Businesses that are thriving and have an Adjusted EBITDA of more than a $1MM are in very high demand,” said Sundeep Gill of GillAgency business brokerage in New York.

The BizBuySell Insight Report is a nationally-recognized economic indicator that tracks the health of the U.S. small business economy. Each quarter, BizBuySell analyzes sales and listing prices of small businesses across the United States based on approximately 50,000 businesses for sale and those recently sold, reporting changes in closed transaction rates, valuation multiples and other economic indicators for the small business transaction market. Closed transactions are reported to BizBuySell.com on a voluntary basis by business brokers nationwide. Each report includes real small business data on over 70 major U.S. markets and across 65 small business